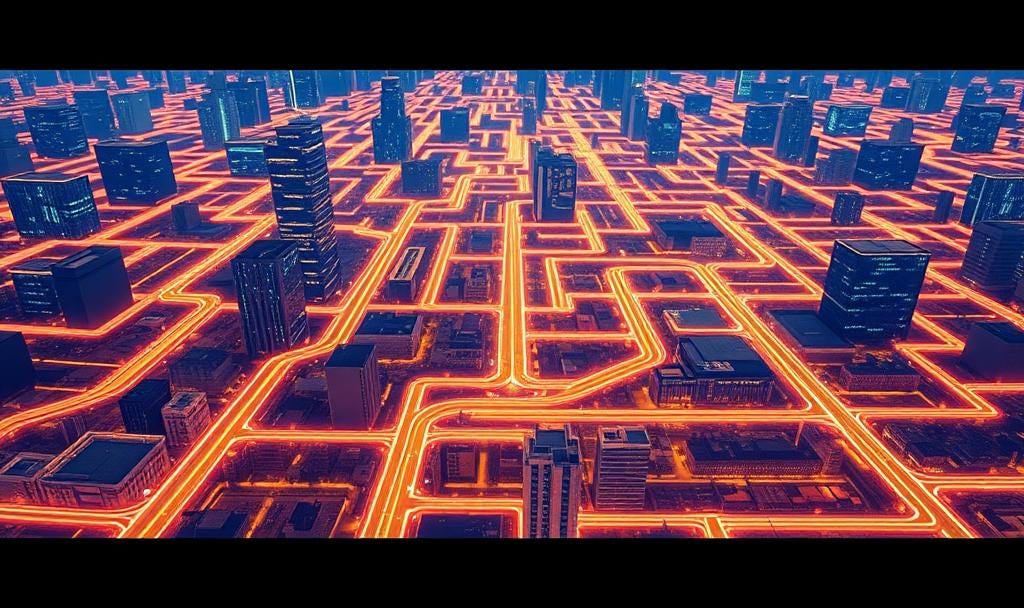

Navigating the Regulatory Maze: The Central Challenge for Fintech in 2025

Balancing innovation and compliance in a rapidly evolving financial landscape

Introduction

In the dynamic world of financial technology, where innovation drives progress at breakneck speed, regulatory compliance stands as the most formidable hurdle. Fintech companies, from nimble startups to established giants, are reshaping how they save, spend, and invest. Yet, their ability to innovate is tethered to an increasingly complex web of regulations that vary across borders and jurisdictions. As of 2025, compliance is not just a legal necessity but a strategic imperative that shapes business models, customer trust, and market competitiveness. A 2024 survey by Alloy revealed that 93% of fintech firms grapple with compliance challenges, with nearly a quarter citing its cost as their primary concern, surpassing even fraud. This article delves into the multifaceted issue of regulatory compliance in fintech, exploring its challenges, implications, and strategies for navigating this critical landscape.

The Regulatory Landscape: A Global Patchwork

The fintech sector operates in a globalised economy, but regulations are far from uniform. In Europe, the General Data Protection Regulation (GDPR) imposes stringent data privacy requirements, with fines reaching up to 4% of annual global turnover for violations. In the United States, a fragmented regulatory framework means fintechs must navigate a maze of federal and state laws, such as the Bank Secrecy Act for anti-money laundering (AML) and varying state-level licensing requirements for money transmission. Meanwhile, emerging markets like India and Nigeria are rapidly tightening their oversight, with frameworks like India’s Digital Personal Data Protection Act adding new layers of complexity. This patchwork creates a daunting challenge for fintechs operating across borders. A single misstep can lead to multimillion-dollar fines, as seen in 2023 when a major fintech player was penalised $10 million for AML violations in the U.S. The diversity of regulations demands that companies invest heavily in legal expertise and compliance infrastructure, often diverting resources from innovation or customer acquisition. For smaller startups, this burden can be particularly crushing, forcing some to limit their geographic reach or exit markets altogether.

The Cost of Compliance: A Barrier to Scale

Compliance is not just a regulatory hurdle; it’s a financial one. The costs associated with meeting regulatory requirements are substantial, encompassing everything from hiring compliance officers to implementing sophisticated software for monitoring transactions. According to a 2024 report by Deloitte, mid-sized fintech firms spend an average of 10-15% of their operating budgets on compliance-related activities. For smaller players, this percentage can be even higher, squeezing margins and limiting their ability to compete with larger incumbents. These costs are compounded by the need for continuous adaptation. Regulatory frameworks are not static; they evolve in response to new technologies, market risks, and political pressures. For instance, the rise of decentralised finance (DeFi) has prompted regulators worldwide to explore new rules for blockchain-based platforms, with the EU’s Markets in Crypto-Assets (MiCA) regulation set to reshape the crypto fintech space in 2025. Fintechs must remain agile, updating systems and processes to align with these changes, often at significant expense.

Technology as a Double-Edged Sword

Technology, the very backbone of fintech, plays a dual role in the compliance challenge. On one hand, advanced tools like artificial intelligence (AI) and machine learning are revolutionising compliance efforts. AI-powered systems can analyse vast datasets to detect suspicious transactions, flag potential fraud, or ensure adherence to Know Your Customer (KYC) requirements with unprecedented efficiency. Companies like Chainalysis have leveraged such technologies to help fintechs comply with AML regulations, reducing false positives and streamlining operations. On the other hand, the same technologies that empower fintechs also attract regulatory scrutiny. The use of AI in lending, for example, has raised concerns about algorithmic bias, prompting regulators in the U.S. and EU to demand greater transparency in how these models make decisions. Similarly, the adoption of blockchain for cross-border payments invites questions about traceability and accountability, particularly in jurisdictions with strict AML laws. Fintechs must therefore balance the adoption of cutting-edge technologies with the need to satisfy regulators’ demands for oversight and fairness.

The Human Element: Building a Compliance Culture

Beyond technology and budgets, regulatory compliance hinges on people. A robust compliance culture starts at the top, with leadership setting the tone for prioritising adherence to regulations. Yet, fostering such a culture is no small feat, particularly in fast-paced fintech environments where speed to market is often prioritised over procedural rigour. Training employees to understand and navigate complex regulations is essential but time-consuming, and high turnover in the tech sector can disrupt continuity in compliance efforts. Moreover, the human element extends to customers. Fintechs must educate users about their compliance obligations, such as providing accurate information for KYC processes or understanding the risks of new financial products. Failure to do so can lead to customer dissatisfaction or even regulatory penalties if users inadvertently violate laws. For example, crypto exchanges have faced challenges in ensuring users comply with tax reporting requirements, leading to increased scrutiny from tax authorities in multiple countries.

Strategic Responses: Turning Compliance into Opportunity

While compliance presents significant challenges, forward-thinking fintechs are turning it into a competitive advantage. By embedding compliance into their core operations, companies can build trust with customers and regulators alike. For instance, neobanks like Revolut have invested heavily in compliance frameworks, enabling them to expand into new markets while maintaining regulatory approval. Similarly, partnerships with regtech firms—specialised providers of regulatory technology—allow fintechs to outsource complex compliance tasks, freeing up resources for innovation. Collaboration with regulators is another effective strategy. Some fintechs participate in regulatory sandboxes, where they can test innovative products under controlled conditions with regulatory guidance. The UK’s Financial Conduct Authority, for example, has pioneered this approach, enabling fintechs to refine their offerings while ensuring compliance. Such collaboration not only reduces the risk of violations but also positions companies as proactive players in shaping future regulations.

Conclusion

Regulatory compliance is the linchpin of the fintech industry’s growth and sustainability in 2025. While it poses significant challenges—financial, operational, and strategic—it also offers opportunities for those who navigate it effectively. By investing in technology, fostering a compliance-driven culture, and collaborating with regulators, fintechs can turn a potential obstacle into a cornerstone of their success. As the industry continues to evolve, those who master the art of compliance will not only survive but thrive, shaping the future of finance in an increasingly regulated world.

MY MUSINGS

As I reflect on the state of regulatory compliance in fintech, I’m struck by the delicate balance between innovation and oversight. It’s almost paradoxical: the very technologies that make fintech so transformative—AI, blockchain, real-time payments—are the ones that keep regulators on edge. I wonder if we’re approaching a tipping point where regulators might stifle innovation under the guise of consumer protection or if fintechs can find a way to co-evolve with regulatory frameworks. Could regulatory sandboxes become the norm globally, or are they just a temporary bridge? And what about the smaller players—can they realistically compete when compliance costs are so high, or will we see consolidation as only the biggest survive? I’m curious about your thoughts. How do you see fintechs balancing the need for speed and innovation with the weight of compliance? Are there specific technologies or strategies you think could ease this burden? Share your perspectives—I’d love to hear how you envision the future of this dynamic industry.

Take your expertise to the next level. Whether you're focused on fintech, banking, operational risk, global payments, or blockchain, my CPE-certified Illumeo courses deliver real-world insights grounded in decades of experience as a banker, business analyst, and trainer. If you found this article valuable, you'll gain even more from the structured, practical training in these online courses. Click the “My Illumeo Courses” link below to explore.